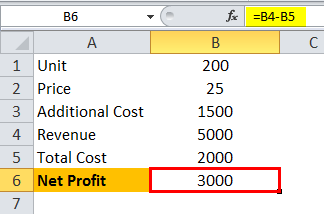

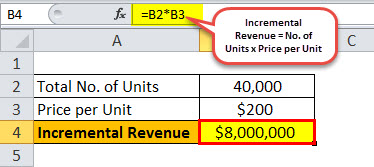

Multiply the number of units by the price per unit. You can then subtract your operating expenses in order to compute your Incremental Net Operating Income.

You then subtract the purchase price of the goods.

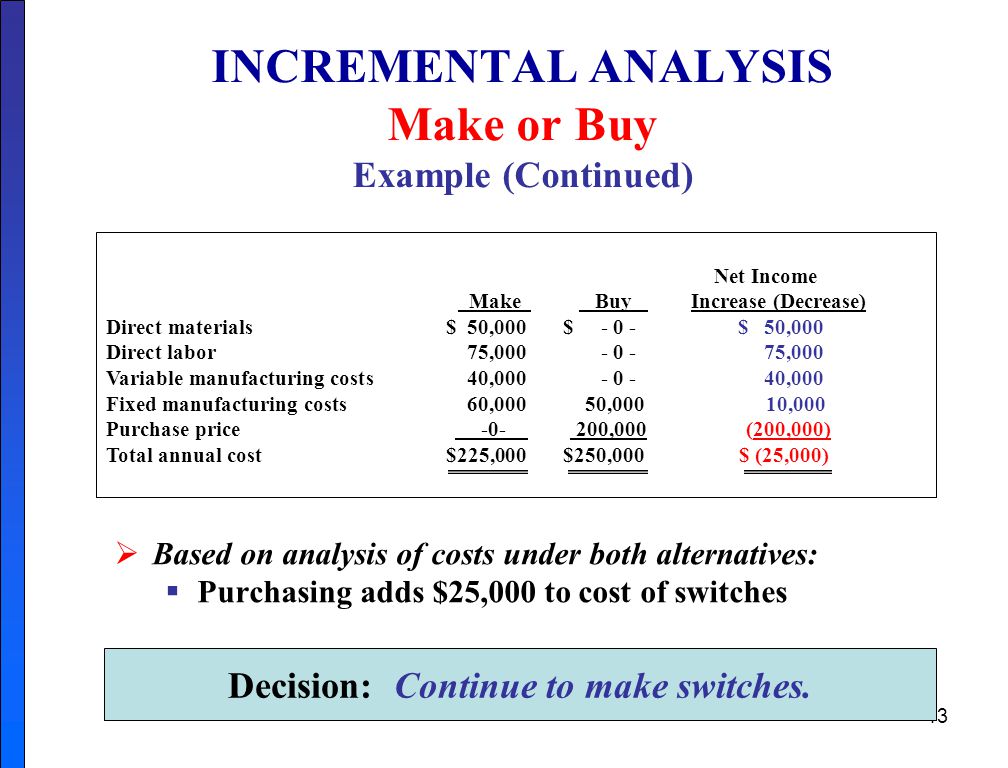

How to find incremental manufacturing cost. You calculate incremental cost by computing the difference between total cost and the total cost when additional units are produced and then dividing by the number of additional units. Naturally this total manufacturing cost does NOT include the costs. Incremental Costs in Managerial Accounting.

Review the formula for incremental cost changing from producing one product to producing two products Total cost. With this figure a manager can remove the total manufacturing cost from revenue to understand the relationship between manufacturing profit and sales. It reported the following costs and expenses for the month.

Incremental cost is the extra cost associated with manufacturing one additional unit of production. How much incremental manufacturing cost would Send Proposal. You can now use this number to make business decisions and compare the revenue to incremental costs.

This video shows how to use the Incremental Cost Allocation Method to allocate a common cost to multiple users. 100 per unit for producing a product. Determine the number of units sold during a period of growth.

With these three items discovered a firm can then simply calculate the total manufacturing cost. Other costs dont change you can just treat these expenses as irrelevant. Determine the price of each unit sold during a period of growth.

Managerial accountants sometimes refer to incremental costs as relevant costs. The reason for the relatively small incremental cost per unit is due to the cost behavior of certain costs. Dozier Company produced and sold 1000 units during its first month of operations.

The key steps involved in computation of the incremental cost are. So in this case you will have. Cost plus and Incremental pricing method 1.

The result is incremental revenue. Determine the amount incurred as the cost of producing one good. This consists of all variable costs of.

Therefore for these 2000 additional units the incremental manufacturing cost per unit of product will be an average of 20 40000 divided by 2000 units. When you need to choose between two alternatives incremental costs change depending on which alternative you choose. In terms of financial statements manufacturing costs appear on the cost of goods manufactured statement while manufacturing expenses are shown on the income statement.

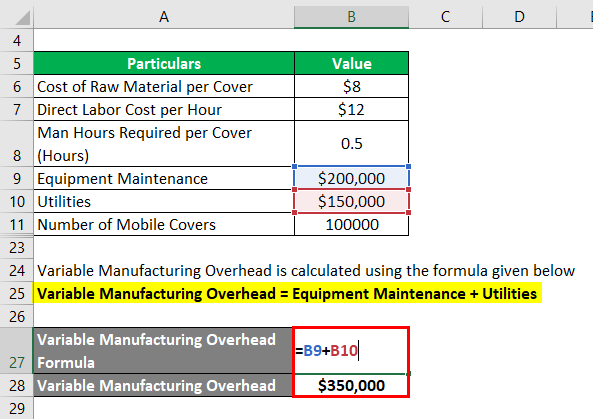

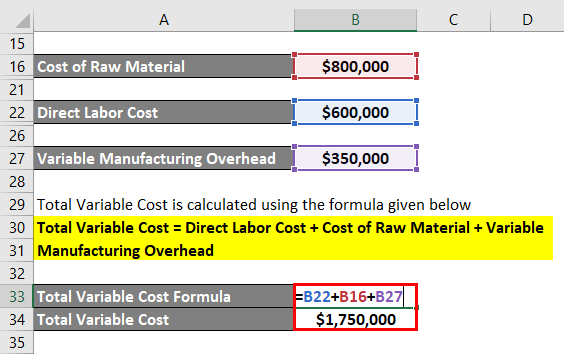

Pricing Techniques Pricing Practices Indra Prasad Pyakurel 2. Your Net Operating Income is calculated by subtracting your operating expenses from your gross profit. Total Manufacturing Cost Direct Materials Direct Labor Firm Overhead.

20000 x 100 2000000. Marginal cost represents the incremental costs incurred when producing additional units of a good or service. For example XYZ organization bears the total cost of Rs.

Incremental cost is calculated by analyzing the additional expenses involved in the. Component Production Cost - the incremental cost to produce one more item after it is in production. This method requires you to first designate.

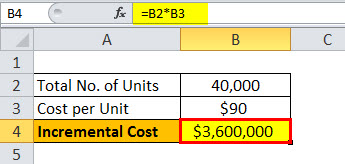

In cost-plus pricing method a fixed percentage also called mark-up percentage of the total cost as a profit is added to the total cost to set the price. Example of Incremental Cost Picture a busy factory that is producing machinery parts. You calculate your incremental cost by multiplying the number of smartphone units with the manufacturing cost per smartphone unit.

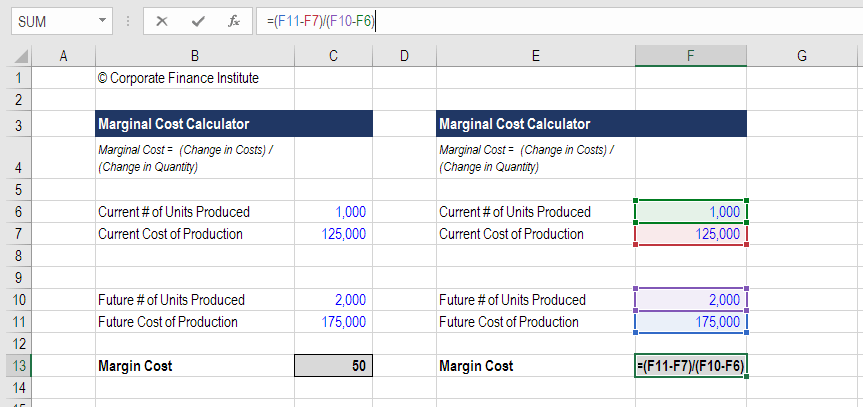

It is calculated by taking the total change in the cost of producing more goods and dividing that by the change in the number of goods produced. Comparing a product to others can give a rough idea of manufacturing cost when you know the mark up. Your gross sales are the total receipts from all of the goods that you have sold.

Incremental costs are the additional costs that are linked with the production of one extra unit and it takes only those costs into consideration that have the tendency to change with the outcomes of a particular decision while the remaining costs are deemed irrelevant with the same. Incremental cost is the total cost incurred due to an additional unit of product being produced. The minimum order price is often the biggest start up cost.

Divide the cost by the units manufactured and the result is your incremental or marginal cost. For example if a company has room for 10 additional units in its production schedule and the variable cost of those units that is. Incremental or marginal cost is the amount of money it will cost a business to make one additional unit.

This usually includes raw material machine time cost. However the amount of manufacturing costs are not necessarily reported on the income statement in the period incurred. Some of the current period manufac.

It can be useful when formulating the price to charge a customer as part of a one-time deal to sell additional units.

Marginal Cost Formula Definition Examples Calculate Marginal Cost

Incremental Cost Definition Example How To Allocate

Total Variable Cost Formula Calculator Examples With Excel Template

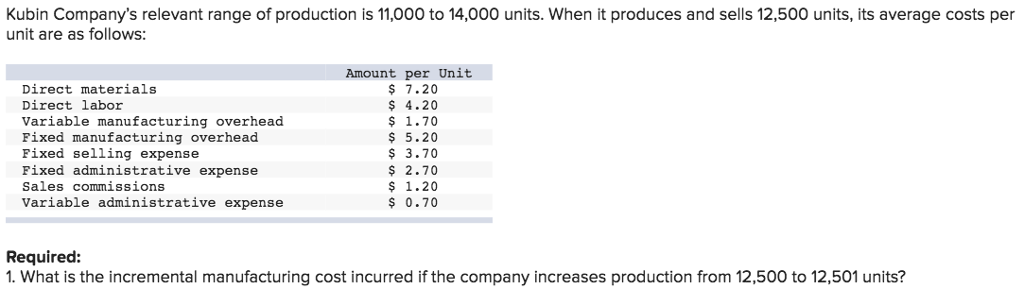

Solved Kubin Company S Relevant Range Of Production Is 17 Chegg Com

Examples Of Incremental Analysis

Solved Q What Total Incremental Cost Will Martinez Incur Chegg Com

Chapter 6 Incremental Analysis Study Objectives Ppt Video Online Download

Solved 2 What Is The Incremental Cost Incurred If The Co Chegg Com

Incremental Revenue Definition Formula Calculation With Examples

Incremental Cost Definition Example How To Allocate

Chapter 6 Incremental Analysis Study Objectives Ppt Video Online Download

Total Variable Cost Formula Calculator Examples With Excel Template

Incremental Revenue Definition Formula Calculation With Examples

Solved Total Variable Costs For Manufacturing 2 And 4 Uni Chegg Com